ABSTRACT

For several centuries, Africa has been regarded as an economic basket case among the world’s five habitable continents. However, Africa has dominated the economic history of hominins, of humans, and of homo sapiens until the end of the last Ice Age about 12,000 years ago. It was also an early mover in the transition from nomadic forager, scavenging, and hunting economies to sedentary economies based on a large farming sector supported by smaller but vibrant manufacturing and services sectors. Up to about the end of the 15th century, Africa’s economic reputation was on a par with those of Europe and Asia and was higher than those of north and south America. The continent did then experience about 500 years of relative economic decline. But since the turn of the present century, the African economy has been growing strongly. If its member countries can place constraints on the pursuit of economic rents by their political leaders, adopt free and open trading systems, and provide a welcoming environment to foreign direct investment, then at the end of this century Africa should have the second largest in the world - behind that of Asia, but more than three times larger than the economies of north and south America combined, and almost seven times the size of the economy of Europe.

HISTORY

Hominins have existed for about 10 million years – as Australopithecines from 10 to 3 million years ago (MYA) and as humans since then. Australopithecines lived only in Africa. Humans did the same in their first two million years and seem only to have moved outside Africa in significant numbers during the last 90 thousand years. Hence, the economic history of the world’s hominins for more than 99% of their existence is identical with the economic history of hominins in Africa and the economic history of Earth’s humans for 97% of their existence is largely synonymous with the economic history of humans in Africa.

During the period of the Australopithecines – from anamensis to africanus –economies was organised around small, nomadic family groups whose main economic strategy was foraging. The first humans, Homo habilis, who dominated for about a million years and were the first hominins to make tools, formed larger groups and included scavenging as an economic strategy. Their successor, Homo erectus, who had a larger brain than habilis, an upright stance, and better tools formed larger groups still and added hunting to the growing list of economic strategies.

For most of the next 2 million years, the basic economic entity continued to be a nomadic tribe and the overall economic strategy remained a mixture of foraging, scavenging, and hunting. However, economic behaviour was becoming more sophisticated, especially after the emergence of Homo sapiens sapiens (modern humans) about 100,000 years ago. With a larger and more complex brain than their predecessors, modern humans accelerated the development of better tools and more sophisticated organisational skills, enabling them to hunt a wider range of animals including larger animals such as mammoths, bisons, and rhinoceroses (Hooke & Alati, 2021).

Then, about 12,000 years ago, a 100,000-year Ice Age came to an end. The global average temperature, which had bottomed out about 10,000 years earlier, has since been rising at an average rate of about 0.5OC per millennium (a mini – ice age ended about 200 years ago, which would have contributed to a higher rate since then). The combination of a physical environment more supportive of plant and animal life and a more intelligent and better-equipped population of humans led to the emergence of a new economic strategy – farming. This became the dominant economic strategy until the start of the Industrial era in about 1800 CE.

According to eminent economic historian, Graeme Snooks (1989) modern economic systems (comprising distinct agricultural, industrial, and services sectors supported by effective overall economic governance) date back about 6,000 years. During the first 1,000 years of this modern period, the largest and strongest economies were drawn from about a dozen city-states located in Mesopotamia, an area between the Tigris and Euphrates Rivers that covered a large part of the fertile crescent. These economies largely discarded foraging, scavenging, and hunting as important economic strategies. They adopted farming – the cultivation of crops and the grazing of animals – as the dominant economic strategy but also added trade and conquest as significant supporting strategies.

During much of the following three millennia, north-east Africa contained some of the world’s largest and most influential economies. The earliest of these was the economy of Ancient Egypt. Small farm-based settlements had emerged along the banks of the Nile River as early as 4000 BCE. These had been amalgamated into the two kingdoms of Lower Egypt (also known as the White Land because of the colour of its soil) in the north and Upper Egypt (the Red land) in the south. They were unified in about 3100 BCE when Menes, ruler of Upper Egypt, conquered Lower Egypt (Mlambo, 2018). Unified Egypt probably then replaced successive individual city states of Mesopotamia as the world’s largest economy.

The Pharaohs ruled Egypt for about 3,000 years. At a time when little change was occurring in the economies of Europe and the Americas, that of Egypt was completing the transition from small nomadic foraging, scavenging, and hunting tribes to a large, sedentary agrarian state. The transition was facilitated by the importation of domesticated crops and animals from the fertile crescent, the construction of irrigation channels along the Nile, and the development of more sophisticated farming tools (e.g., hand-held and oxen-pulled ploughs, hoes, rakes, winnowing scoops, and flint-bladed sickles). The main crops grown were wheat, barley, flax, vegetables, and fruits. Surpluses generated in good seasons were stored in large granaries and used to support their owners in the poor seasons. They were also used to pay taxes to the government. Censuses were conducted regularly, not to count the population and describe its demographic characteristics but to the determine the taxable capacity of farming estates based on such features as the numbers of cattle, sheep, and goats they possessed. The tax revenue in turn supported the lifestyle and aspirations of the spiritual and political leaders, including conquest of neighbouring states and the construction and maintenance of large tombs and pyramids. Trade was conducted with other economies - in Nubia to the south, the Mediterranean to the north and west, Sinai to the northeast, and the Red Sea to the east. Egypt exported grains, linen, and papyrus in exchange for ebony, ivory, and ostrich feathers from middle Africa; timber and stones (needed for the pyramids) from the Middle East; and spices, incense, and precious stones from Asia. Egypt’s economy declined steadily during the first millennia BCE due partly to climate change making farming more difficult and increasing political unrest. Egypt was conquered by the Greeks in 332 BCE and from about 30 BCE fell under Roman control (Anoba, 2019).

Africa’s second great economy – and one of the earliest modern black economies - was that of Kush, a kingdom located along the Blue and White Nile Rivers in modern-day Sudan. Kush was an Egyptian colony during 1560-1070 BCE. It flourished after the Egyptians withdrew, and in about 750 BCE Kush conquered Egypt and ruled as Pharaohs for more than a century. During this period, the Kush empire extended form Khartoum in the south to the Mediterranean in the north, and from the Red Sea in the east to the Libyan desert in the west (Anoba, 2019). The Kushites were expelled from Egypt by Assyrian forces in about 663 BCE but Kush remained a major power in the Sudan for another thousand years. Its continued prosperity was based on the production of gold, incense, and ebony and on trade with Egypt and settlements along the Mediterranean and in the Middle East. Kush’s independence and prosperity ended in 350 CE when it was conquered by a new growing African power, Aksum.

The economy of Aksum flourished during the first eight centuries of the Common Era. At its height, its boundaries covered much of modern Eritrea, Ethiopia, and Sudan as well as, during the 6th century CE, southern Saudi Arabia and the Yemen. Along with Egypt during the periods of the Old and Middle Kingdoms (2696-1700 BCE), Aksum was, during its zenith, also a contender for the position of world’s largest economy. In about the third century, a respected Persian prophet wrote: “There are four great kingdoms on earth: the first is the Kingdom of Babylon and Persia: the second is the Kingdom of Rome; the third is the Kingdom of the Aksumites; the fourth is the Kingdom of the Chinese.” (Anoba, 2019). Aksum’s wealth was based on a powerful navy, which allowed it to control the trade networks along the Nile River and the southern Red Sea. During the 3rd and 4th centuries CE, it was one of Rome’s most important trading partners. Aksumite merchants imported products from India and Arabia, such as emeralds, ivory, incense, gold, silk, salt, obsidian, sandalwood, and spices, which they traded in Egypt, Kush, and inner Africa. The Aksumites were responsible for the transition of north African trade from a barter system to a much more efficient, monetary-based system. The economy of Aksum peaked in the 4th century CE, under King Ezana, who is also famous for making Aksum the first African kingdom to formally adopt Christianity as the official religion. Aksum’s economy began to decline in about the 6th century CE, due to increasing degradation of farmlands, repeated incursions by neighbouring nomadic tribes, and growing competition in trade from the Arabs. Its independence and prosperity ended in the 8th century CE, when it was conquered by the Rashidun Caliphate.

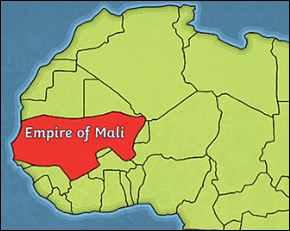

The transition from the last glacial period to the current warming period led to the transformation of the Sahara from a wet and fertile region to a desert. The latter formed a barrier between the early modern economies of western Africa and those of the Mediterranean and Middle Eastern regions until the arrival of the camel in about 300 CE. The unique physical characteristics of the camel allowed trade across the desert and facilitated the economic development of states that were on the most popular trade routes. Ghana, whose early capital, Kumbi-Saleh, was on the southern edge of the desert, was among the first to capitalise on this advantage. The main commodities traded there were salt, ivory, gold, copper, kola, ostrich feathers, grains, and slaves. Ghana collapsed in the 13th century and control of the lucrative trans-Saharan trade routes passed to the Mali Empire, which was founded in 1230 CE.

Mali thrived for about three centuries. At its peak, in the 14th century, its territory stretched from the Atlantic Ocean to beyond the Niger River in the south and to the salt and copper mines of the Sahara in the north. Mali became famous during this period partly due to the exploits of Mansa Musa (King Musa). In 1324–25 CE, Musa made a religious pilgrimage to Mecca. He took with him a hundred camel-loads of gold, large amounts of which he distributed in Cairo. The gave rise to considerable inflation in Egypt. News of Musa’s wealth spread to Europe, leading to West Africa being widely regarded as a land of fabulous riches and Musa as the richest person in the world. It also led to a substantial increase in trade between Mali and the Mediterranean (Mlambo, 2018).

Following the decline of Mali, Songhai became the new leading power in West Africa. King Sonni Ali (1464–1492) developed a more unified and efficient economy by standardizing weights and measures and introducing a common currency throughout the empire. The export of gold from Songhai and the import of salt to Songhai formed the backbone of the cross-Sahara trade. Sonni Ali also built dykes along the Niger River, which permitted irrigation that considerably enhanced farm yields. Under the rule of Askia Muhammad Toure (1493–1528), Songhai became become the largest and most powerful empire in the history of west Africa. Its Sankore University, in the city of Timbuktu, was regarded as one of the finest in the Islamic world and attracted many students from Europe and the Middle East. The Songhai empire collapsed in 1591 when it was invaded and defeated by armies from Morocco.

Bantu-speaking people in southern Cameroon led the spread of the new, post-Ice Age technologies (crop farming, grazing, and iron-based products) throughout sub-Saharan Africa. There were two main migration streams. One was eastward to the Great Lakes regions of northern Tanzania and southern Kenya. This migration occurred between the second and fifth centuries BCE. The second was southward, through Botswana, during the first to seventh centuries BCE (Mlambo, 2019).

As a result of the technologies brought by the Bantus, states in southeast Africa also have a long economic history. Early in the first millennium BCE, they were exporting ivory, rhino horn, and coconut oil in exchange for weapons and other iron products. Following the arrival of Islam in the 7th and 8th centuries, trade expanded with the Persian Gulf, India, and China. Traders took advantage of the trade winds of the Indian Ocean, which blow toward Africa from November to March and toward India from April to October. During this period, the main exports from the region were ivory, gold, and slaves and the chief imports were manufactured goods - especially luxury products such as glassware, silks and cottons, and pottery.

Ibrahim Anoba (2019) claims that in about 1500 CE, these African states stood at the same level in terms of economic strength as the ancient Greeks and Romans. They contained functional division of labour, private ownership of the means of production, and market exchange of goods and services. Unfortunately, instead of enjoying the benefits of open market economies, improved farming technologies, and new industrial technologies in the last half of the second millennia CE, Africa experienced a large increase in trading of slaves, colonialism, and subsequent slow recovery in the early post-colonial period.

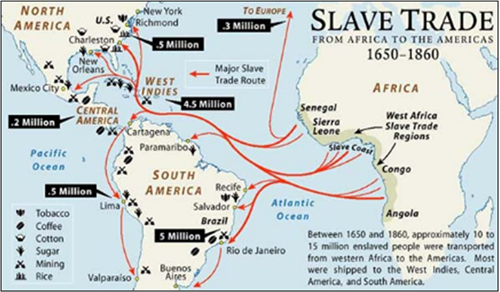

Slavery and slave trading have existed throughout recorded history in many parts of the world – e.g., in Iberia (Spain and Portugal) and the Middle East. Since at least the first millennium BCE, slaves had been owned by wealthy Africans and had been traded along the trade routes of the Sahara desert, the Mediterranean Ocean, the Red Sea, and the Indian Ocean. However, the scale, nature, and effects of the cross-Atlantic slave trade were unprecedented in human centre.

The trigger for the development of this trade may have been a decision by the Roman Catholic Church to grant economic monopolies over resources in the Americas to Spain and in West Africa to Portugal. In 1455, Pope Nicholas V issued the Romanus Pontifex, which affirmed not only Portugal’s monopoly over trade in West Africa but also its right to “reduce their persons [i.e., the West Africans] to perpetual slavery” (Elliott, 2019).

Portugal initially transported slaves - mostly convicted criminals and prisoners of ethnic African wars - to work on sugar plantations in Portugal’s island possessions of Principe and Sao Tome. Later, the Portuguese took the sugar cane crop and the practice of slavery across the Atlantic Ocean to Portugal’s western colony, Brazil. Both the crop and slavery spread to the Caribbean and surrounding islands, and then to mainland America. The slave trade was dominated by Portuguese merchants during the 16th and first half of the 17th century, by Dutch traders in the latter 17th century, and by British and French merchants in the 18th and early 19th centuries. The system that emerged became known as the triangular trade. The first stage began in Europe, where manufactured goods such as knives, guns, ammunition, cotton cloth, tools, and brass dishes were shipped to ports on the west African coast. There, the goods were exchanged for enslaved people, gold, ivory, and other materials. The second stage (the “middle Passage”) comprised the transport of the slaves and goods to the New World (mainly Brazil and the Caribbean Islands because of their location) where they were exchanged for sugar, rice, tobacco, indigo, rum, and cotton. The third stage was the shipment of these plantation crops and other products back to Europe. Widespread sentiment against slavery on humanitarian grounds, development of markets for and rising productivity of non-slave labour, and rising costs of maintaining slaves led to the abolition of slavery in Great Britain in 1807 and in all British colonies in 1833-34. The official practice ended when Brazil abolished slavery in 1888.

Scholars generally agree that the trans-Atlantic slave trade had a severe effect on the economic development middle west, central, and east Africa. During the late 16th to the early 19th century, about 12 million slaves were exported from Africa to the Americas (of whom about 10 million survived the Atlantic crossing). However, this number understates the effect of the trade on economic development in Africa. First, the slaves were overwhelmingly young healthy men who, in other parts of the world, were leading the transition from the farming to the industrial era. Second, the opportunity to make money by selling slaves led to a climate of lawlessness and violence that discouraged economic investments in both traditional and new economic activities (Lewis, 2022).

Following the formal abolition of slavery, Britain and other European countries sought to promote trade with Africa, encouraging imports of commodities such as palm oil, cocoa, groundnuts, and minerals. They also adopted a policy of seeking to abolish the practice of slavery in Africa. Unfortunately, this apparently well-meaning policy led to European interventions in Africa that possibly had more negative long-term effects on economic performance than slavery. It introduced the paternalistic colonial period.

At the end of the 19th century, leading European countries partitioned Africa among themselves. They then established three types of colonies in their allocated areas: settler, peasant-agricultural, and concession-company colonies. Settler colonies were set up in southern Africa, Kenya, and Algeria. They comprised large, resident white-settler communities that ran their own political and economic systems and used the local Africans mainly as a source of cheap labour. Peasant agricultural colonies operated in west, central, and east Africa. Local farmers retained ownership and formal control of their land but were strongly encouraged to grow cash crops such as groundnuts, palm oil, and cocoa, which were sold in European markets. Marketing arrangements and prices were controlled by the European colonisers, limiting the benefits to African farmers. Concession-company colonies were operated by private companies that made little effort to include the local population in ownership or management, practices that could have facilitated transfer of the technology and skills needed to provide substantial and sustainable benefits for the local economies.

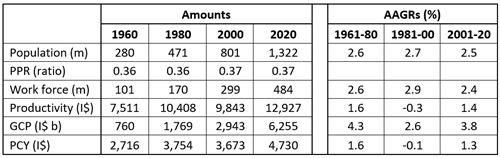

Most colonised African countries gained their independence during the 1950s and 1960s. At that time, their economies were characterised by subsistence or plantation farming; poor transport, power, health, and education infrastructure; and a scarcity of ownership and management skills. Nevertheless, many of the newly independent economies enjoyed strong economic growth during the 1960s and early 1970s. However, this was due mainly to a very dynamic world economy, where the private sectors in Europe, Asia, and America were making up for the growth in peace-time goods and services lost during the Great Depression and World War II and were providing a strong and rising demand for raw materials. This papered over the economic and political fragility of most African countries. The global recessions of the mid-1970s and early 1980s exposed these fragilities. The average annual growth rate (AAGR) of Africa’s gross continental product (GCP) fell from 4.3% in 1961-80 to 2.6% in 1981-2000. The AAGR of labour productivity, which was 1.6% in 1961-80, was minus 0.3% in 1981-2000. However, the African economy recovered strongly in the first two decades of the 21st century, with the AAGR rising to 1.4% for labour productivity and 3.8% for GDP (Table 1). Performance during the early part of this century casts doubt on the widespread view that Africa faces a future of long-term poverty.

Table 1. Economic growth of Africa, 1961-2000

Source: Compiled from CIA, UN, and World Bank publications.

THE CURRENT SITUATION

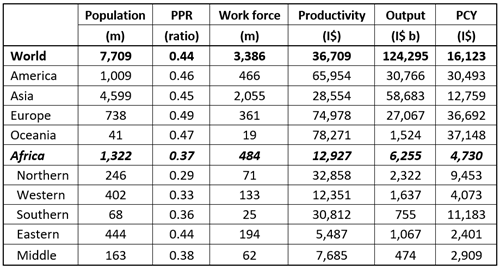

In 2020, Africa’s population amounted to 1,322 million, or 17% of the global population. However, Africa’s work force, of 484 million, was only 14% of the global work force. This smaller ratio was due to what is commonly referred to as a demographic burden. A relatively large part of Africa’s population was too young to be in the formal work force - 40% were aged 14 years and below, compared to 26% globally. Africa’s labour productivity, of I$ 12,927 was the lowest among the five habitable continents and was 35% of the global average. Accordingly, Africa’s GCP, of I$ 6,255 billion, accounted for only 5% of gross world product (GWP). Its per capita income, I$ 4,730, was only 29% of the global average (Table 2).

Table 2. Africa in the world economy, 2020

Source: Compiled from CIA, UN, and World Bank publications.

The situation differed considerably among the major regions of Africa. Labour productivity was 89% of the global average in northern Africa, which accounted for a fifth of the continent’s population, and was 84% of the global average in southern Africa. However, it was only 34% in western Africa, 21% in middle Africa, and 15% in eastern Africa. On a country basis, labour productivity was above the global average in seven countries: Equatorial Guinea (35% above), Gabon (30%), the Seychelles (26%), Egypt (20%), Mauritius (13%), Botswana (8%), and Algeria (5%).

THE FUTURE

The forecasting model

The scenario outlined below has been derived from the Hooke/Alati World Income Model (Hooke & Alati, 2021). This model contains annual estimates for 1960-2020 of demographic and economic data for 168 countries that comprise more than 99% of the global population. The model for GDP is:

|

GDPt = LFt * LVt |

(1) |

|

LFt = PPRt * Pt |

(2) |

|

PPRt = PPRt-1 * (1 + pprt) |

(3) |

|

LVt = LVt-1 * (1 + lvt) |

(4) |

Where:

- LF is labour force

- LV is labour productivity

- P is population

- PPR is the ratio of the work force to population

- ppr is the rate of growth of the PPR

- lv is the rate of growth of labour productivity

The scenario used in this chapter assumes that present political boundaries will be unchanged throughout the remainder of the 21st century. It uses population estimates for 2020 and projections for later years from the UN Population Division’s website. Estimates of the labour force and GDP have been obtained from the World Bank’s website. The projections of the labour force assume that the population participation ratio (PPR – the proportion of the population that is in the work force) will converge smoothly to 0.50 (the current rate in Europe) in 2080 for African economies and 2050 for all other economies.

The key variable influencing the model’s projections of GDP is labour productivity. It is assumed that the trajectory of each country’s labour productivity depends on (1) the outward movement of the global technology frontier, (2) the country’s position relative to the frontier, (3) the potential of the country to reach the frontier, and (4) the date on which it will realise that potential. It is assumed that the United States, the current technology-leader, will remain on the frontier for the rest of this century. It is also assumed that the frontier will continue moving outward at its current rate of about 1.5% a year.

The process by which countries close their labour-productivity gap with the technology leader is based on convergence theory. The convergence model divides economic eras into three phases: the breakaway, catch-up, and fine-tuning phases. It also divides economic entities into two categories: the technology leaders and the technology followers. The process begins with the development of a new technology, such as farming 12 thousand years ago and industrial technology a little more than 200 years ago. During the breakaway phase, the productivity (and per capita income) of the technology-leaders (e.g., the city-states of Mesopotamia and Egypt during the farming era) rises but is unchanged for the technology followers. In the catch-up phase, the followers adopt the new technology and close their per capita income gap with the technology leaders. In the fine-tuning phase, where participants try to extract the remaining benefits from the increasingly exhausted technology, leaders and followers have similar levels of productivity and per capita income. Special assumptions are made for highly regulated and more inward-looking economies such as those of China, North Korea, and Russia, where historical performance suggests the existence of a significant long-term trade-off between political stability and economic growth. (For a more detailed discussion of convergence theory, see Hooke & Alati, 2021.)

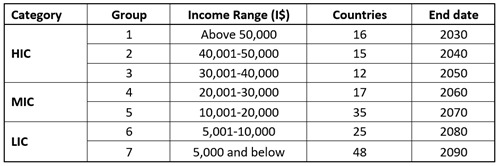

The scenario assumes that labour productivity in most countries has the potential to converge with that of the United States during this century. To calculate individual convergence trajectories, countries are classified into seven groups based on per capita income (which is the more-frequently-used variable in convergence theory and is closely related to labour productivity) in 2020 (Table 3). It is assumed that convergence takes place at a geometric rate that is constant within countries but, of course, differs across countries. Completion of the convergence process for individual countries depends on their per capita income in 2020 and ranges from 2030 for the highest-income countries (Group 1 in Table 4) to 2090 for the lowest-income countries (Group 7).

Table 3. Convergence date of per capita incomes, 2030-2100

Source: Income data were derived from the World Bank’s website. Income classifications

and projections of convergence completion dates were made by the authors.

Projections of GDP in Africa

The labour force

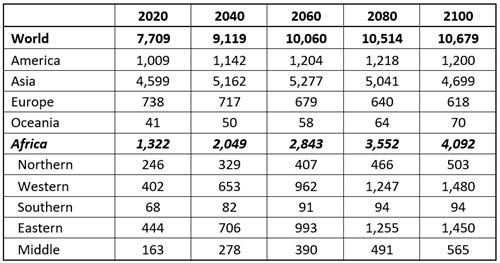

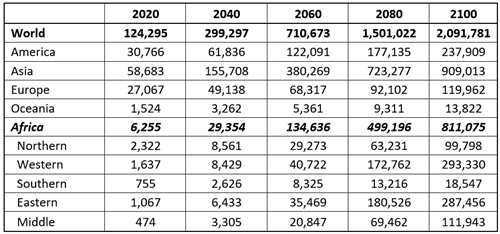

The main determinant of labour force size is population. Table 4 shows the UN Population Division’s estimates of population for 2020 and projections to 2100 for selected continents and environs and for major African regions. They suggest that the global population will rise, though at a diminishing rate, in each of the four projection periods, and in 2100 will be 39% higher than in 2020. Before the end of the century, population will start to decline in America, Asia, and Europe. In 2100, population will still be rising in Africa. According to convergence theory, this will confer a long-term economic benefit on Africa.

Table 4. Population of selected regions and countries, 2020-2100

(millions)

Source: Compiled from data published by the United Nations’ Population Division.

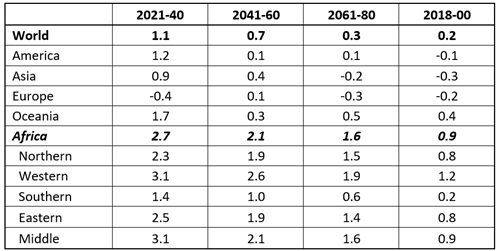

Table 5 shows projections of the AAGR of the labour force, which depend on the AAGR pf both population and the PPR. Labour force growth in Africa is projected to fall from 2.7% in 2021-40 and 2.1% in 2041-60 to 1.6% in 2061-80 and 0.9% in 2081-2100. However, it remains well above the corresponding rate for all other continents in all periods. Within Africa, work force growth is highest in Western Africa. It is lowest in Southern Africa, where it is not significantly different to that in the rest of the world.

Table 5. Labour force growth in selected regions and countries, 2020-2100

(AAGR in percent)

Source: Table 4 and projections of PPRs by the author.

Labour productivity

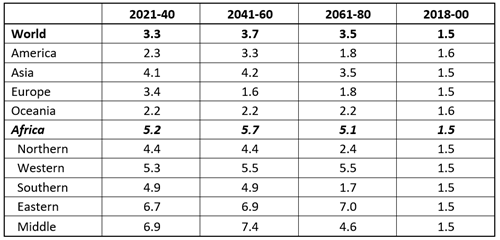

The model contains 53 African countries. The Seychelles, the country with the highest per capita income in Africa, is placed in Group 4 (I$ 20,001 < PCY < I$ 30,000) in Table 3 above and so is assumed to complete the process of labour productivity convergence in 2060. Eight countries are placed in Group 5 (I$ 10,001 < PCY < I$ 20,000) and complete the convergence process in 2070. Nine countries are in Group 6 (I$ 5,001 < PCY < I$ 10,000) and complete the process in 2080. The remaining 35 countries are in Group 7 (PCY < I$ 5,000) and catch up to the rest of world in 2090. Annual productivity growth in Africa averages 5.4% during the catch-up phase of convergence. It should be noted that this is less than half the rate achieved by successful Asian economies when they were in the same phase, and when technology was less supportive of information transfer. With the appropriate policies, most African countries could have better performances than are projected in this scenario.

Table 6. Labour productivity growth in selected regions and countries, 2020-2100

(AAGR in percent)

Source: Projections from the Hooke/Alati World Income Model.

GDP

Table 7 shows the implications of the assumptions outlined above for gross product GDP in the habitable continents and their environs as well as for major regions in Africa. selected countries and regions. It suggests that the impact of Africa on the world economy during the remainder of this century could be similar to that of Asia during 1980-2020. The share of Africa in GWP is projected to rise from 5% in 2020 to 10% in 2040, 19% in 2060 and 39% in 2100. At the end of the century, Africa will have the second-largest GRC, behind Asia (44%) but ahead of the Americas (11%) and Europe (6%). Within Africa, the shares in GWP of both the Western and Eastern regions will rise to 14% and those of the Northern and Middle regions will increase to 5%.

Table 7. Gross Product of world, continents, and African regions, 2020-2100

(I$ billions)

Source: Projections from the Hooke/Alati World Income Model.

CONCLUSIONS

The key assumptions of the above scenario concern population, the population participation rate, the growth rate of the global technology frontier, the potential of countries to achieve productivity convergence, and the pace at which they move toward convergence. Demographic data give strong confidence that the population growth rate in Africa, while declining, will continue to be higher than on other continents. Trends in the age-composition of populations make it almost certain that Africa’s population participation rate will rise relative to the corresponding rates elsewhere. These two factors will translate into a rising share of Africa in the global workforce.

The main question then becomes: Can Africa generate and maintain the conditions necessary for labour productivity convergence? The key conditions for convergence are free trade and a welcoming approach to foreign direct investment (FDI). Adoption of a policy of free trade will ensure that Africa builds on its comparative advantages, the basis of a high level of productivity. Importing FDI from the current technology leaders will provide African countries with easy access to the latest and best global methodologies and practices, the key to high growth of labour productivity.

The challenges facing African economies are common to all economies. They include resisting popular demands for barriers to participation in the work force, such as overly generous or poorly constructed unemployment benefit and age pension programs. They also include a failure to fully appreciate the ability of markets to obtain, process, and disseminate information and to harness the motivating power of self-interest to achieve socially desirable goals. However, challenges also present opportunities. If African economies can free-up their markets, provide adequate transportation, power, and ICT infrastructure, ensure a legal and internal security system that supports property rights, and minimise rent seeking by local officials charged with facilitating FDI, they could advance considerably the pace of economic convergence well above the rates discussed in this chapter.

REFERENCES

Anoba, I. (2019). Commerce and trade in ancient Africa – Egypt. https://www.libertarianism.org/columns/commerce-trade-ancient-africa-egypt.

Anoba, I. (2019). Commerce and trade in ancient Africa – Kush. https://www.libertarianism.org/columns/commerce-trade-ancient-africa-kush.

Anoba, I. (2019). Commerce and trade in ancient Africa – Aksum. https://www.libertarianism.org/columns/commerce-trade-ancient-africa-aksum.

Elliott, M., and Hughes, J. (2019). Four hundred years after enslaved Africans were first brought to Virginia, most Americans still don’t know the full story of slavery. The New York Times Magazine.

Hooke, A. and Alati, L. (2021). Technology and gross world product: From Homo habilis to Homo techne. Technological Breakthroughs and Future Business Opportunities in Education, Health, and Outer Space. IGI Global.

Lewis, T. (2022). Transatlantic slave trade. https://www.britannica.com/topic/transatlantic-slave-trade.

Mlambo, A. (2018). African Economic History and Historiography. https://oxfordre.com/africanhistory/view/10.1093/acrefore/9780190277734.001.0001/acrefore-9780190277734-e-304.

Snooks, G. (1989). The dynamic society, Routledge.

UN Population Division (2022). https://population.un.org/wpp/Download/Standard/Population/

World Bank (2022). https://data.worldbank.org/indicator/SP.POP.TOTL.

BIOGRAPHY

Angus Hooke is Emeritus Professor, Senior Scholarship Fellow, and Director of the Centre for Scholarship and Research (CSR) at UBSS. His earlier positions include Division Chief in the IMF, Chief Economist at BAE (now ABARE), Chief Economist at the NSW Treasury, Professor of Economics at Johns Hopkins University, and Head of the Business School (3,300 students) at the University of Nottingham, Ningbo, China. Angus has published 14 books and numerous refereed articles in prestigious academic journals.