Issue 2 | Article 10

Abstract

The invention and development of computing hardware and accounting software have transformed accounting practices. Processes that were performed manually in the latter part of the 20th century are now executed by computers using sophisticated accounting software packages. As a result, new graduates entering the accounting profession must not only possess a thorough knowledge of accounting principles and processes, they must also have strong computing skills. In this article, the author discusses how she introduced a sophisticated computer package into a postgraduate course in accounting and how combining this with an appropriate weight in assessments increased student motivation, participation, and performance.

Introduction

The history of accounting is thousands of years old. In 4000 BC, traders in Mesopotamia, home of the world’s first documented civilisations and economies, were keeping records of transactions using clay tokens as symbols for objects and putting marks on them to denote their number. Later, these and other details were recorded on papyrus, and then on paper.

The concept of double-entry book-keeping was documented in 1494 by Luca Pacioli, a housemate of Leonardo da Vinci and widely recognized as the ‘Father of Accounting and Bookkeeping’. Pacioli included a description of this golden rule, which was being practiced in parts of Italy, in his mathematics book Summa de Scriputa (Chapter 5).

Accounting has three beautiful qualities: (1) The recording of financial transactions is the same in virtually all businesses around the world; (2) Generally Accepted Accounting Principles (GAAP) have been widely adopted across businesses; and (3) All humans deal with accounting concepts in their daily lives. For example, suppose that I am a student at UBSS (Universal Business School Sydney). I am sitting in a class because of a business transaction. I have two changes and UBSS has two changes. My changes are: (1) I paid tuition fees and (2) I am receiving an education service. Similarly, UBSS has two changes: (1) UBSS received money from me and (2) UBSS is providing the education service to me.

The introduction of technology has changed enormously the role of modern professional accountants. Most repetitive accounting tasks are now computerised; accountants can rely on spreadsheets and software packages for much of their daily work. Information technology has had a significant impact on accounting. It has enabled businesses to develop and use computerised systems to record, process, and store important details of financial transactions.

Rationale

Modern professional accountants use a wide range of computer applications to assist them in their daily work. They use email to communicate, search engines to undertake research, and accounting software to record and analyse financial transactions for business decision-making. Computerised accounting systems have replaced manual accounting systems in most organisations throughout the world. Technological advancements help accountants to keep accurate records of business transactions. Technology has provided the accounting industry with new avenues to explore, create new products and services, and enable its professionals to gain new skills and take on new responsibilities.

Today, accounting is cloud-based. COVID-19 completely changed the business landscape. Cloud-based accounting came to the forefront, with a wide range of benefits for business: it is online; it is secure; and users can easily and quickly access their management systems, core financial data, and inventory systems to ensure their business runs smoothly during this turbulent time. Cloud-based accounting has allowed accountants to be mobile and reactive to the needs of their clients. Importantly, it has also put businesses in touch with clients that are not just around the corner but are across the globe. Continuing professional development and education in this area will be necessary for accountants.

Moreover, the development of sophisticated accounting software enhances accountants’ mobile capabilities. Wherever they are, accountants can use their smartphones to provide quotes, generate invoices, reconcile bank statements, pay bills, analyse business operations, and ensure that wages are paid on time. An understanding of accounting software and other business and financial models will be necessary if practicing accountants are to prepare financial statements in an effective and timely manner and to discharge their responsibilities properly.

At UBSS, MBA accounting students are increasingly being exposed to the benefits of computerised accounting. Computerised accounting packages are being included in subjects and assessments are being updated to reward students who use these packages.

Reality

This article explains the impact that introducing an accounting software package (MYOB) to the subject Accounting Systems and Processes has had on students’ acquisition of practical accounting knowledge. Today’s accountants use a wide range of computer applications to perform routine tasks in the workplace. They use accounting software to record, analyse, and process financial information needed for business decision making. Computerised accounting systems now play a vital role in communicating business financial reports to known and unknown users. At UBSS, MBA accounting students are encouraged to practice computerised accounting to better prepare them for their future careers.

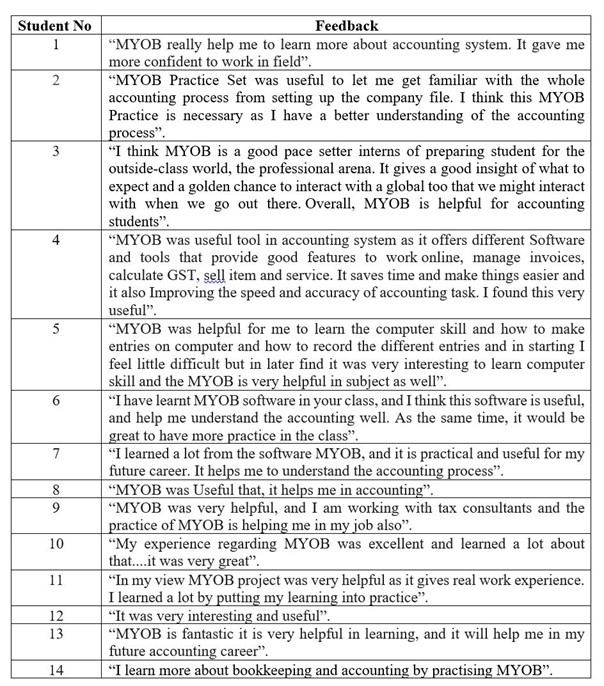

In 2018, the unit Accounting Systems and Processes was introduced in the MBA program. It had four assessments: Test 1: 15%, Test 2: 15%, Group presentation 20%, and Final exam 50%. Under this assessment allocation, students had little engagement with computerised accounting. At that time, students learnt mainly manual accounting. As computerised accounting has considerable benefits for students seeking to enter and succeed in the Australian job market, MYOB was added in 2019, and the assessment allocation was changed to Test 15%, Computerised accounting practice 25%, and Final exam 60%. The explicit and relatively high share of the new module in overall assessment was aimed at giving students more motivation to learn computerised accounting systems. The author’s observation is that before introducing MYOB, student attendance in classes was relatively low. After introducing the package, student attendance was relatively high. This is reflected in students’ anonymous feedback after completing the unit, which is also shown in unit results (Table 1). Appendix 1 provides further anonymous student feedback, which was sent by email (Trimester 2, 2021).

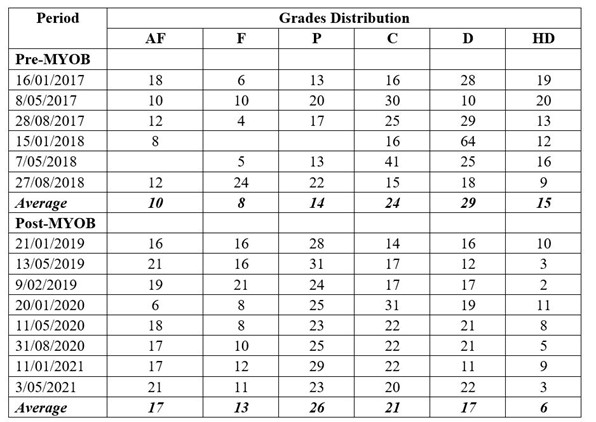

Table 1. Percentage Grades Distribution Pre- & Post-MYOB

Key: AF - Absent Fail, F - Fail, P - Pass, C - Credit, D - Distinction, HD - High Distinction.

Data source: UBSS Management (GCA).

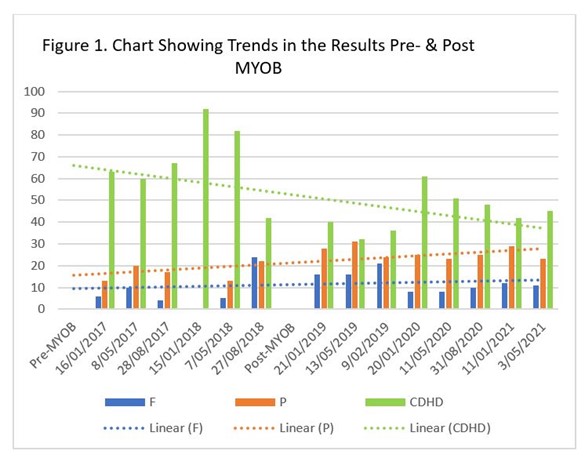

The results suggest that students’ performance over the trimesters has improved, including when the shares of Fail and Pass, and Fail-to-Credit, Distinction and High Distinction are considered. Figure 1 shows this relationship through the trends. However, while the percentage of Fail grades has declined with the introduction of MYOB and the percentage of Passes has increased, the percentages of other favourable results (Credit, Distinction and High Distinction combined) has declined. It is important to note that a student’s top priority is to achieve at least a Pass, and that attaining a Credit or higher grade is a secondary (though for some, still a very important) objective. It seems that the introduction of MYOB has inspired weaker students to become more involved in their studies and this has led to a better outcome in the form of a higher percentage passing the exams.

Data source: UBSS Management (GCA)

Students’ feedback (Appendix 1) indicates that the inclusion of computerised accounting and giving it a high weight in the assessment for the subject has had a highly positive impact on both the learning of students and their keenness to work in the accounting profession. This suggests that computerised accounting can be effectively utilised and integrated in class to improve students learning of accounting. Studying manual accounting systems is still required because of the greater depth of understanding gained by going through each step in the documentation and recording of individual business transactions, but computerised accounting increases student knowledge, skills, job-readiness, and confidence.

The future

The author’s experience with introducing MYOB into Accounting Systems and Processes suggests student learning outcomes might be improved by the inclusion of computerised accounting modules in other subjects. For example, the software “Active Data Excel” could be offered in the unit Auditing, and the software “MS Visio” could be added to the subject, Accounting Information Systems.

Conclusions

Teaching and learning are two-way communication processes that require active participation by both teachers and students. Effective implementation of computerised accounting in subjects motivates students to play a more active role in the learning process, and this can assist them to better understand subject matter by doing what will be required of them in the real world. Computerised accounting provides considerable benefits for students. It allows them to apply the knowledge they have gained in class and therefore accelerates the learning process. Using accounting software in a subject provides a more accurate reflection of industry practice, which may better prepare students for the challenging contemporary business world and the ever-changing accounting profession. Undertaking practical exercises in computerised accounting can provide valuable learning experiences for students. These active learning experiences can significantly enhance students learning.

References

Abed, S. 2014. A review of e-accounting education for undergraduate accounting degrees. Int. Bus. Res., 7: 113-119.

Ballard, B. and Chandry, J. (1991). Teaching Students from Overseas: A Brief Guide for Lecturers and Supervisors, Longman Cheshire, Sydney.

Boyce, G. (1999). Computer-assisted teaching and learning in accounting: pedagogy or product?, Journal of Accounting Education, Vol. 17 Nos 2/3, pp. 191-220.

McDowall, T. and Jackling, B. (2006). The impact of computer-assisted learning on academic grades: an assessment of students’ perceptions, Accounting Education: An International Journal, Vol. 15 No. 4, pp. 377-389.

Appendix 1. Anonymous student feedback sent by email (T2, 2021)

Biography

Dr. Nilima Paul is Assistant Professor in Accounting at UBSS. She has Bachelor of Commerce (Honours) degree, a Graduate Certificate in Tertiary Education, a Master of Commerce degree, and a Doctor of Philosophy degree. Nilima is a member of the National Tax and Accounts Association, the Australian Institute of Training and Development, and the Association of Accounting Technicians. She has been teaching accounting to undergraduate and postgraduate students in a range of universities and colleges for more than 30 years and has won numerous awards for her commitment to teaching and learning.